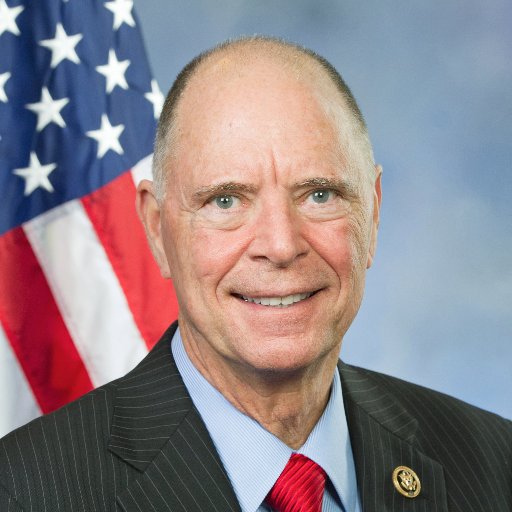

U.S. Rep. Bill Posey (R-FL) introduced Wednesday legislation to repeal the National Credit Union Administration’s (NCUA) final risk-based capital rule.

The final rule, which is set to take effect Jan. 1, 2019, would establish a new risk based capital (RBC) ratio for credit unions with over $100 million in assets. Specifically, it changes the definition of “complex credit union,” for the purposes of capital requirements, to include credit unions greater than $100 million in assets. Further, it sets an RBC ratio of 10 percent for well-capitalized credit unions and 8 percent for adequately-capitalized credit unions. It also higher minimum levels of capital for credit unions with concentrations of assets in real estate loans, commercial loans or non-current loans.

Posey’s bill, the Common Sense Credit Union Capital Relief Act (H.R. 4464), would repeal that measure, stating that it would unfairly categorize credit unions as complex financial institutions that should not operate without setting large amounts of capital aside. Posey said this bill may force some credit unions to limit their services or close their doors.

“Millions of Americans throughout our communities utilize the important financial services offered by our local credit unions,” Posey said. “There are great concerns about the cost of this rule on credits unions, the legal authority of the NCUA to implement this rule and the regulatory burden this rule will have on credit unions. This bill will ensure that credit unions do not tie-up scarce resources that would otherwise be made available to credit union members and our communities in the form of loans and lower interest rates.”