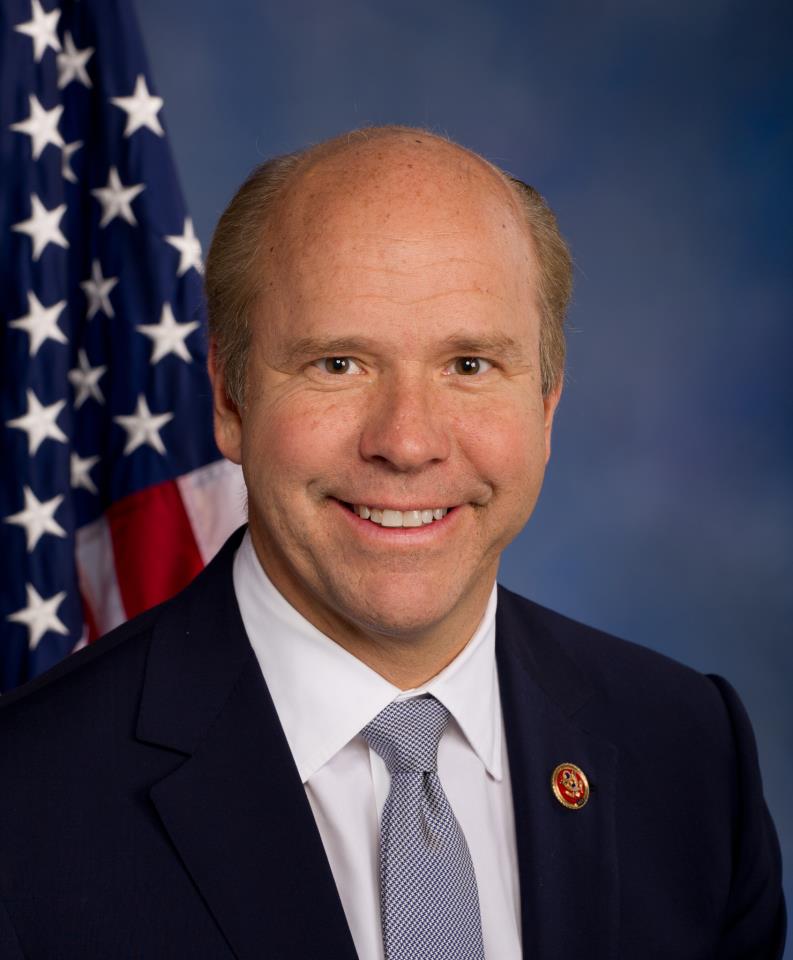

U.S. Rep. John Delaney (D-MD) recently suggested that President Donald Trump should use revenue from international tax reform to rebuild America’s infrastructure.

“This is a moment of truth decision for President Trump and his domestic agenda,” Delaney said. “Pairing infrastructure and tax reform is the surest way to really create jobs and help businesses grow in a fiscally-responsible way. If the President wants to get a deal done, if he wants a win, this is the way you do it, by using revenues from international tax reform to rebuild our failing infrastructure. After working on this issue for four years, we’ve had liberals, moderates and conservatives cosponsor our bills, we’ve won the backing of members of the Freedom Caucus and the Progressive Caucus. The American people deserve to see a serious proposal tomorrow, a proposal that encourages broad growth and prosperity and the best way to do that is to include a smart infrastructure program.”

Trump is supposed to unveil his tax reform plan this week, according to reports.

In March, Delaney introduced the Infrastructure 2.0 Act and the Partnership to Build America Act along with Reps. Ted Yoho (R-FL) and Rodney Davis (R-IL).

The Partnership to Build America Act (H.R. 1669) establishes the American Infrastructure Fund (AIF) to provide financing to state and local governments for new infrastructure. Transportation, energy, communications, water and education projects are eligible to receive AIF financing. Local governments would apply directly to the AIF for support.

To encourage public-private partnerships 35 percent of AIF supported projects must have at least 10 percent of their financing be private debt or equity. The AIF will be capitalized by $50 billion in infrastructure bond sales and leveraged at a 15-to-one ratio to provide up to $750 billion in loans or guarantees.

Rather than using appropriated funds out of the federal budget to establish the AIF, Delaney’s bill would use a bond sale. AIF bonds would have a 50-year term, pay a one percent fixed rate return and would not be guaranteed by the U.S. government.

To incentivize companies to purchase these bonds, U.S. companies would be allowed to repatriate a certain amount of their overseas earnings tax free for every $1 they invest in the bonds. This multiplier will be set by a “reverse Dutch auction” – which allows the market to set the rate, ensuring that enough funds are raised. Assuming a one-to-four ratio is set by the auction, a company will be able to repatriate $4 tax-free for every $1 in AIF bonds they purchase.

Through his Infrastructure 2.0 Act, existing overseas profits accumulated by U.S. multi-national corporations would be subject to a mandatory, one-time 8.75 percent tax, replacing deferral option and current rate of 35 percent. This frees the estimated $2 trillion in overseas earnings to return to the United States, spurring private sector re-investment and growth.

It would generate an estimated $120 billion to the Highway Trust Fund, $50 billion to capitalize the American Infrastructure Fund (AIF), and $25 million pilot program to create regional infrastructure accelerators, similar to the West Coast Infrastructure Exchange

The Infrastructure 2.0 Act creates an eighteen-month deadline for international tax reform. If reform is not enacted, a fallback international tax package to make the U.S. business climate more competitive would be implemented.