The Property Casualty Insurers Association of America (PCI) hosted a policy briefing in Washington, D.C., to discuss ways to insure the millions of families and businesses that are uninsured or underinsured for natural catastrophes.

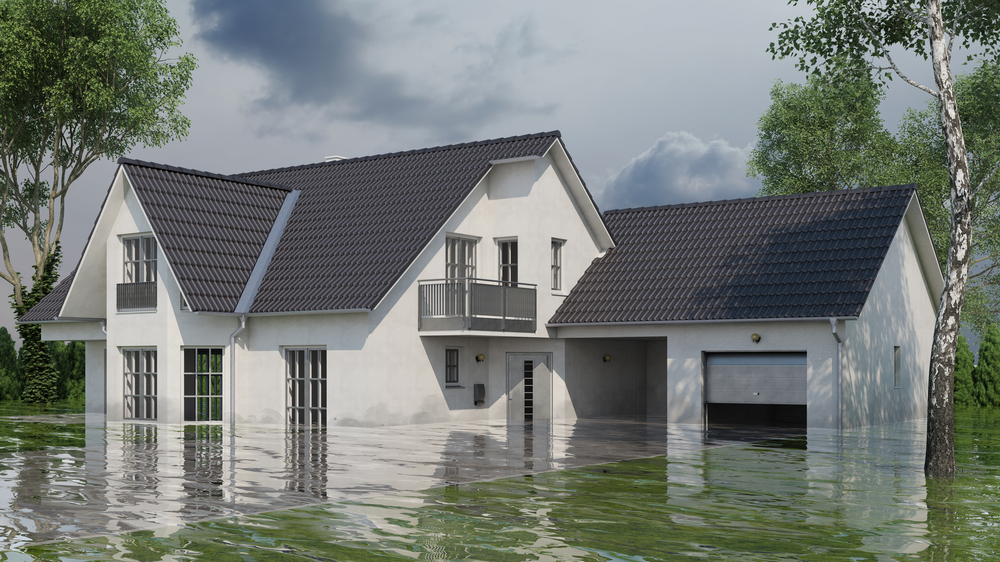

In the briefing, called “Flood Insurance: Bridging the Insurance Gap,” the participants talked about the need to renew the National Flood Insurance Program (NFIP), which expires Nov. 30, and expand opportunities for private insurers.

“Hurricanes Michael and Florence underscore a major and often overlooked public policy crisis – the millions of families and businesses that are underinsured or uninsured for natural catastrophes,” Griffin said. “These storms are yet another reminder that policymakers, insurers, thought leaders, and consumers need to work together to identify solutions for bridging the flood insurance gap. In order to prevent these troubling and catastrophic trends from continuing, Congress must reauthorize the National Flood Insurance Program, which is set to expire on November 30,” Don Griffin, PCI’s department vice president of policy, research, and international, said. “Passing a long-term bill with reforms that expand consumers’ flood insurance options will provide greater stability and reliability for consumers. We also must continue to work together to bring more flood insurance options to the marketplace and educate consumers about the dangers of flooding.”

Griffin moderated the panel of experts, which included Michael Lyons, president and CEO at Weston Insurance Holdings Corporation; Scott Giberson, principal of flood compliance at CoreLogic; and John Rollins, an actuary at Milliman.

“Working together, private insurers and the NFIP can address coverage and affordability issues to narrow the flood insurance gap and insure more properties that are currently uninsured or underinsured,” Lyons said.

Rollins said there is an opportunity to increase the number of households with flood insurance by allowing private insurers to enter the market alongside the NFIP.

“As the NFIP begins to update its rating plans, the latest flood risk science, technology, and data indicate that together, private and federal flood insurance can cover more of both low-risk and high-risk properties at actuarially sound rates while potentially saving many households money on premiums,” Rollins said.