U.S. Rep. Young Kim (R-CA) recently spoke to the importance of eliminating the SALT marriage penalty.

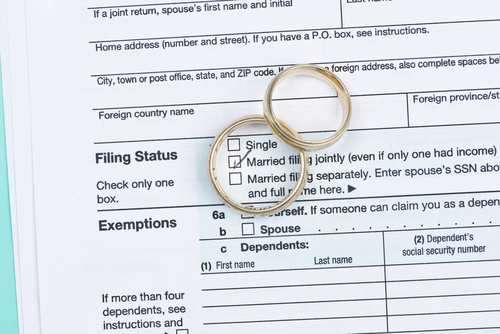

Kim and U.S. Rep. Mike Lawler (R-NY) introduced the SALT Marriage Penalty Elimination Act that would increase the cap on State and Local Taxes (SALT) from $10,000 to $20,000 for married couples – an unfair loophole in the tax code. Kim is the co-chair of the bipartisan SALT Caucus.

“H.R. 7160 will eliminate the so-called marriage penalty on the state and local tax – or SALT – deduction for families who file their taxes jointly,” Kim said on the House floor. “Under the current tax code, married couples filing jointly are penalized and have the same SALT cap of $10,000 as single filers. H.R. 7160 doubles the SALT deduction cap for married couples to $20,000 and does right by them.”

Kim said limited housing supply, high mortgage rates not seen in decades, and high housing costs, are making purchasing a home harder for many Americans and eliminating SALT would ease the burden.

“In my district, the median price of a home is over a million dollars. However, we can pass this rule today to allow us to provide much-needed tax relief and stop discriminating against families through the tax code,” she said. “H.R. 7160 will not mark the end of our fight to provide full SALT tax relief for our constituents – this is only the first step to get us there.”