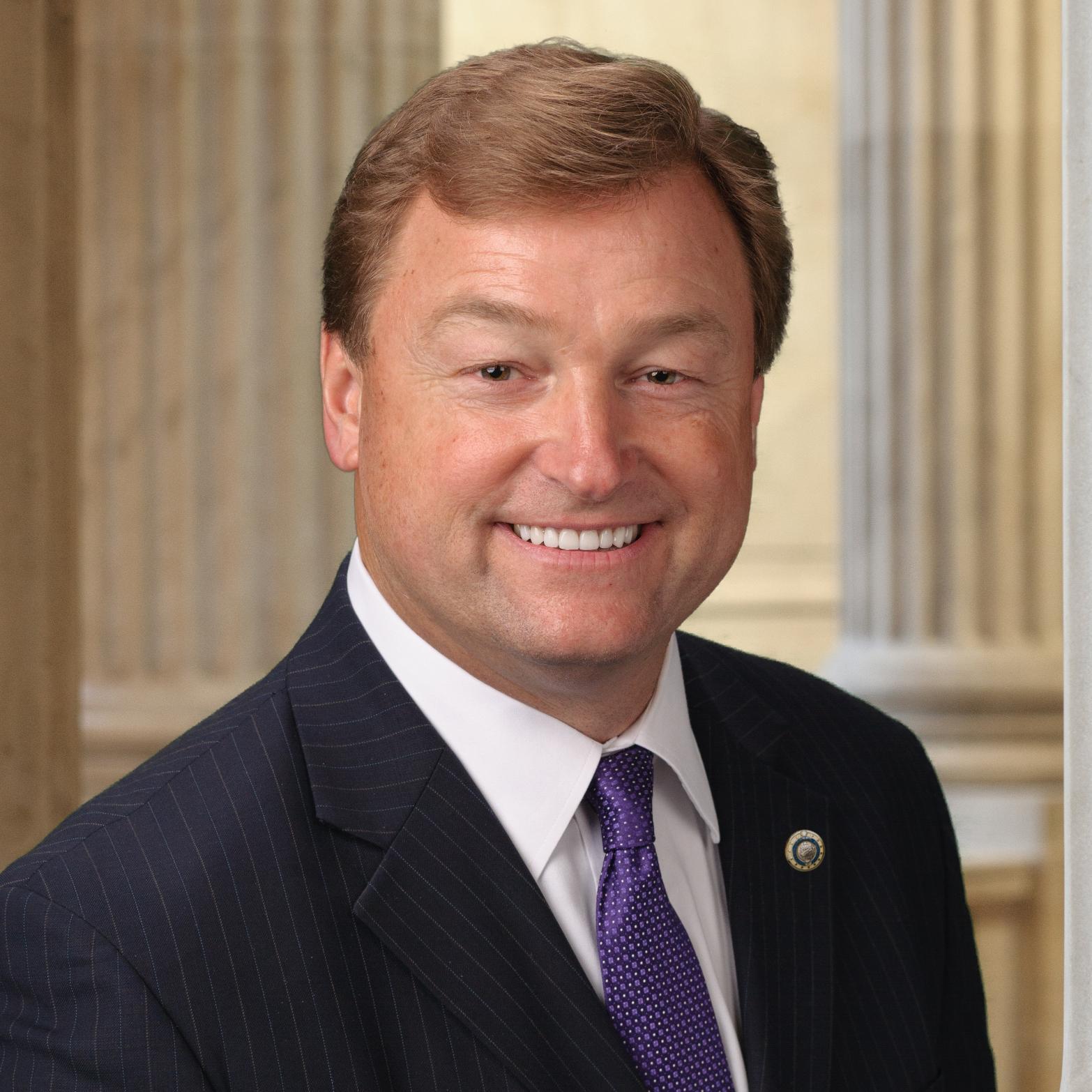

Sen. Dean Heller (R-NV) urged the Senate Banking, Housing, and Urban Affairs Committee to consider his legislation to expand the private flood insurance market, pursuing reauthorization of the National Flood Insurance Program.

Heller and Sen. Jon Tester (D-MT) introduced the Flood Insurance Market Parity and Modernization Act (S.563) earlier this year, which would give consumers greater access to the private flood insurance market. The bill is currently in Senate Banking, Housing, and Urban Affairs Committee

In a letter to committee chairman Mike Crapo (R-ID) and ranking member Sherrod Brown (D-OH), Heller said people need expanded access to flood insurance.

“I appreciate the bipartisan discussions both of you have started to reauthorize the National Flood Insurance Program (NFIP),” Heller said. “Right now, major changes are occurring with the emergence of a growing private flood insurance market. We have a unique opportunity to help more Americans have more access to affordable and sound flood insurance coverage and to put more NFIP financial risks on the private sector and not on U.S. taxpayers.”

Current law restricts some lenders from accepting private flood insurance because it does not meet mandatory purchase requirements. Heller said his bill would address that concern.

“This legislation solves this issue by defining acceptable private flood insurance as a policy that provides flood insurance coverage issued by an insurance company that is licensed, admitted, or otherwise approved to engage in the business of insurance in the state in which the insured building is located, by the insurance regulator of the state,” Heller said. “This legislation will provide more flood insurance options for homeowners and businesses to choose from.”

In re-authorizing the NFIP later this year, Heller urged the committee to eliminate current non-compete rules that prevent companies that write flood policies through the NFIP from also selling flood insurance policies outside of the NFIP.

He also encouraged the NFIP program to secure more reinsurance. Earlier this year, the Federal Emergency Management Agency secured more than $1 billion in reinsurance from 25 reinsurers. This was only the second time in history reinsurance had been secured for the NFIP, Heller said.

“I would request that you consider legislation that would annually yield a portion of the NFIP’s risk to private reinsurers. I would also recommend giving the NFIP explicit access to more securities vehicles that could be used by the NFIP to capture more funding from the private sector,” Heller said.