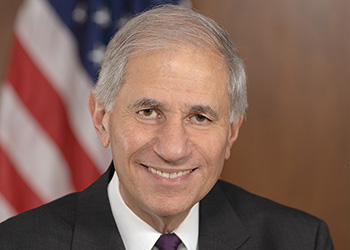

After an investigation by an independent third party, the chairman of the Federal Deposit Insurance Corporation (FDIC), Martin Gruenberg, announced that he has stepped down.

The investigation was based on allegations of sexual harassment within the agency and a toxic work culture at the agency, which the report verified.

“[F]or far too many employees and for far too long, the FDIC has failed to provide a workplace safe from sexual harassment, discrimination, and other interpersonal misconduct,” according to the report by Cleary Gottlieb Steen & Hamilton, shared by CBS News.

Gruenberg announced that he will step down after a successor is named.

“It has been my honor to serve at the FDIC as Chairman, Vice Chairman, and Director since August of 2005,” he said. “Throughout that time, I have faithfully carried out the critically important mission of the FDIC to maintain public confidence and stability in the banking system. In light of recent events, I am prepared to step down from my responsibilities once a successor is confirmed. Until that time, I will continue to fulfill my responsibilities as Chairman of the FDIC, including the transformation of the FDIC’s workplace culture.”

White House officials said a successor will be named soon, although no timeline was given.

U.S. Sen. Tim Scott (R-SC), ranking member on the Senate Banking Committee, had been calling for Gruenberg’s ouster since last December over these allegations. He called on Gruenberg to resign immediately.

“If President Biden and Democrats were really serious about supporting employees and fixing the FDIC’s toxic work culture, they’d ask Chairman Gruenberg to step down immediately. This draw-it-out strategy makes it clear that this administration is prioritizing their political agenda over protecting workers,” Scott said.

U.S. Sen. Sherrod Brown (D-OH), chair of the Senate Banking Committee, joined Scott and Senate Republicans in the call for Gruenberg to step down after a recent Senate hearing on the matter.

“After chairing last week’s hearing, reviewing the independent report, and receiving further outreach from FDIC employees to the Banking and Housing Committee, I am left with one conclusion: there must be fundamental changes at the FDIC. Those changes begin with new leadership, who must fix the agency’s toxic culture and put the women and men who work there – and their mission – first. That’s why I’m calling on the President to immediately nominate a new Chair who can lead the FDIC at this challenging time and for the Senate to act on that nomination without delay. I expect that the entire Banking and Housing Committee and Senate leaders, in both parties, will put politics aside and join this effort to bring new leadership to the agency to ensure a safe workplace for the women and men who protect our financial system.”

Gruenberg has been with the FDIC since 2005 and is the longest tenured chair in history, serving as chair from 2005-2005, 2011-2018, and 2022-2024.