The Capital Markets and Government Sponsored Enterprises Subcommittee on Thursday held a hearing to consider the impact of regulations since 2010 have had on short-term financing in the U.S. capital markets, repurchase agreements, money market funds, and securities financing.

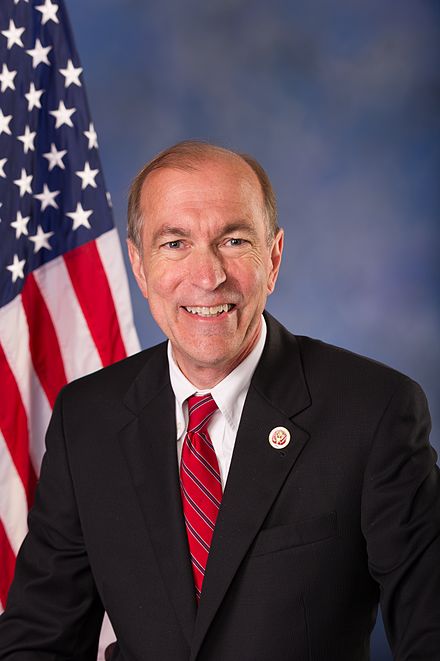

“It’s clear that Main Street is feeling the impact of the hundreds of new rules heaped upon our economy over the last few years,” said U.S. Rep. Scott Garrett (R-NJ), chairman of the subcommittee. “This hearing will be an opportunity to look specifically at short-term financing markets, and the impact that the Volcker rule, Basel liquidity and capital rules, and the SEC’s money market fund regulations are having on Main Street businesses and municipalities in accessing the financial markets.”

Thomas C. Deas Jr., chairman of the National Association of Corporate Treasurers, provided testimony to the committee and said the the new financial regulations since the 2008 financial crisis have tightened the markets for short-term borrowing, which resulted in more volatility, wider spreads and higher rates. Additionally, he added that corporate treasurers have faced increasing difficulty managing liquidity without tying up productive capital or incurring additional substantial financing and hedging costs.

“We feel strongly that several recent financial regulations such as Dodd-Frank, Basel III, money market fund regulations and many more, both alone and in concert with each other, have triggered regulatory and compliance cost burdens that radiate through the economy,” said Anthony J. Carfang of Treasury Strategies in committee testimony.

The committee is set to reconvene at later date to be determined.