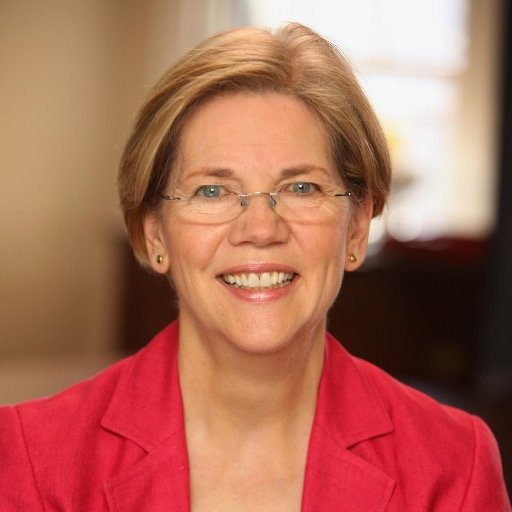

U.S. Sen. Elizabeth Warren (D-MA) is asking the CEOs of 16 large financial institutions if they support or oppose the Consumer Financial Protection Bureau’s (CFPB) plan to eliminate the arbitration clause.

The CFPB’s proposal to eliminate the arbitration clause would allow consumers to file class action suits against banks and credit card companies. The CFPB found that forced arbitration clauses that prohibit consumers from entering class action lawsuits against companies are commonplace in financial product contracts.

Most arbitration clauses require people to bring claims individually against the company, outside the court system, before a private individual (an arbitrator). The CFPB said this makes it more difficult for consumers to hold banks accountable for misconduct. Detractors said consumers who go through arbitration gain more favorable outcomes than those who file class action lawsuits.

In her letter to the CEOs, Warren noted that several associations and lobbying groups representing banks and financial firms have condemned the rule, asserting it will harm consumers.

“These organizations represent your bank and your industry, but you – and other CEOs of large banks – have remained silent on the rule,” Warren wrote. “If your lobbyists are taking such strong positions against the rule, is there a reason both you and your bank have been unwilling to take a public position?”

She asked the financial firms’ CEOs to say whether they agree or disagree with the CFPB’s analysis by Sept. 1.

Warren also requested data on the firms’ use of arbitration clauses in consumer agreements and the outcomes of arbitration proceedings.

“This information is particularly important and time-sensitive because Republicans in Congress have introduced a resolution to reverse the CFPB rule using the fast-track Congressional Review Act process,” Warren said.

The letters were sent to the heads of JP Morgan Chase, Bank of America, Wells Fargo & Company, Citigroup Inc., U.S. Bancorp, PNC Financial Services Group, TD Group US Holdings, Capital One Financial Corporation, HSBC North America Holdings, Charles Schwab Corporation, BB&T Corporation, Suntrust Bank, Barclays US, Ally Financial Inc., American Express Company, and Citizens Financial Group.