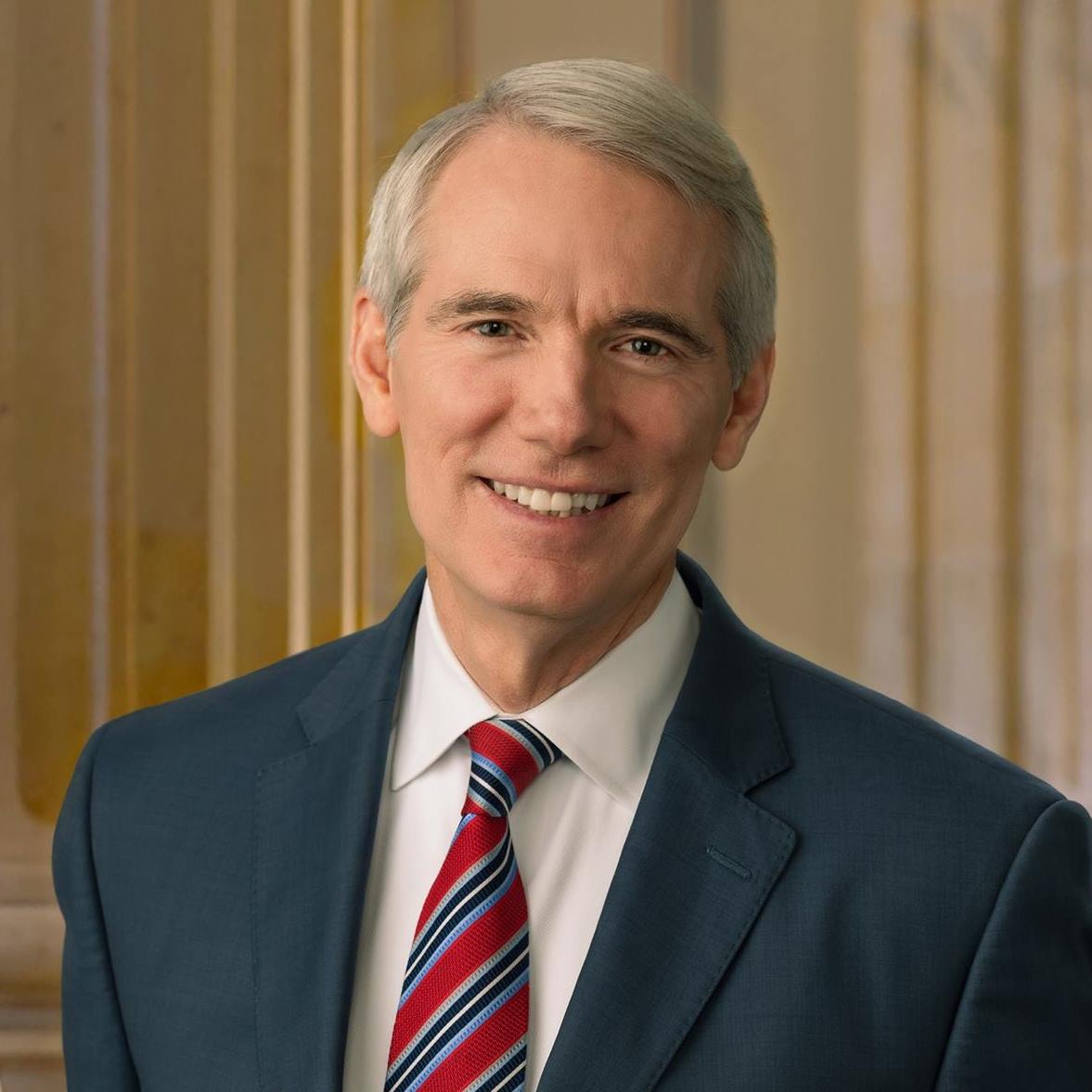

U.S. Sen. Rob Portman (R-OH) took to the floor of the Senate this week to explain how the Democrats’ plan for tax hikes to pay for the $3.5 trillion reconciliation package will hurt small businesses.

Portman said that increases to the income tax, combined with the repeal of the Section 199A small business deduction and other tax provisions, will result in the average small business paying a tax rate of about 48 percent compared to the current average rate of about 29 percent.

“Democrats claim they are just going after large corporations. But unfortunately, that’s not what’s happening. A lot of small businesses are going to be caught in the crosshairs of the income tax hikes the Democrats are proposing,” Portman said. “That’s primarily because 95 percent of small businesses are what’s called pass-throughs. The vast, vast majority of small businesses are partnerships, sole proprietorship or companies that are limited liability companies or subchapter S companies. So the business doesn’t pay the tax directly. The tax is actually paid by the owners of the business on their 1040, their individual tax return. What that means is that successful pass-throughs, which combine to employ about 58 percent of the nation’s workforce, will be taxed in line with whatever the income tax level is.”

Portman explained that the small businesses will, in effect, end up paying a higher rate.

“And there are many reasonably successful pass-throughs that will be lumped into the expanded top bracket of the tax code, which starts at $400,000 in income. These small businesses, through the owner, will end up paying 39.6 percent income tax, plus a 3.8 percent surtax on small business income. You add to that the average state income tax of about 5 percent and that puts the figure for small businesses at about 48 percent on average and well over 50 percent in some states.”

Portman concluded by saying this is not the time to make things worse for small businesses, given workforce shortages, uncertain economic trends, supply chain issues, the COVID-19 Delta variant, and other factors.