Members of the House Financial Services Committee sent a letter to the Office of the Comptroller of the Currency (OCC) urging the implementation of financial inclusion requirements for fintech companies chartered as banks.

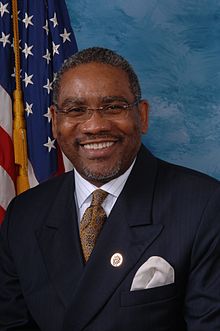

In a recent OCC whitepaper, the office proposed the idea of licensing financial technology, or fintech, companies as banks. U.S. Rep Gregory Meeks (D-NY), senior member of the House Financial Services Committee, who drafted the response letter, said the financial inclusion requirements for fintech firms should be similar to those required of traditional banks under the Community Reinvestment Act (CRA).

“It’s been 40 years since the CRA was enacted, and the financial services industry continues to evolve in pace with new emerging technologies,” Meeks said. “Our consumer laws, including the CRA which requires traditional banks to meet the credit needs of their communities, should also evolve.”

The letter was co-signed by Rep. Cedric Richmond (D-LA), chair of the Congressional Black Caucus, Rep. Gwen Moore (D-WI), Rep. Terri Sewell (D-AL), Rep. Donald Payne, Jr. (D-NJ), and Tony Cárdenas (D-CA).

“By creating a CRA-like framework for fintech companies, the OCC is taking a bold step toward making sure all consumers, not just a few, receive the financial benefits of new technologies,” Meeks said.