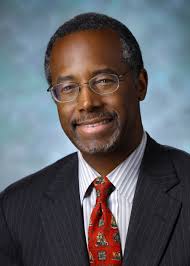

The Department of Housing and Urban Development (HUD) Secretary Ben Carson is considering reviewing its policy on Property Assessed Clean Energy (PACE) loans, which allows homeowners to pay for energy-efficient upgrades through property tax assessments.

Carson said the recent Realtors Legislative Meetings and Expo that HUD is “very amenable to adjusting that policy in the future.”

Critics, including the National Association of Federally-Insured Credit Unions, have raised concerns about the lack of consumer protections surrounding PACE loans.

PACE loans enable mortgage borrowers to finance environmentally friendly home upgrades, such as solar panels and energy efficient appliances. Since the loans are typically initiated by the private companies making these improvements, the financing is raised by issuing municipal revenue bonds. These bonds, secured by the payments on the PACE loan obligation, are added to the borrower’s property tax bill and are paid through property tax installments.

The financing structure is classified as a tax assessment rather than a mortgage product so the loans are not subject to federal consumer protection requirements.

NAFCU supports the bill, “Protecting Americans from Credit Entanglements Act of 2017” (S. 838/H.R. 1958), recently introduced in Congress, which would bring financing for PACE loans under the same Truth in Lending Act consumer protections required of other mortgage products.