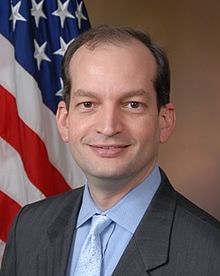

The U.S. Senate confirmed Alexander Acosta as Secretary of Labor last week, a move applauded by the Financial Services Roundtable (FSR), who subsequently asked Acosta to defer the fiduciary rule.

“FSR congratulates Secretary Acosta on his confirmation and we look forward to working with the Secretary to help ensure critically important financial services remain accessible and affordable for America’s workers and their families,” FSR CEO Tim Pawlenty said.

Among the items on its wish list, FSR urged Acosta to defer the Labor Department’s Fiduciary Rule’s June 9 applicability date until a thorough review has been completed. A deferral would allow Acosta to fully examine the rules consequences in accordance with President Trump’s February 3 memo, which directed the DOL to update the economic and legal analysis of its fiduciary rule.

The fiduciary rule requires financial advisers to act in the best interests of their clients in retirement accounts. DOL already pushed back the original implementation date of the rule from April 10 to June 9.

FSR cites research by the American Action Forum (AAF) that said the rule “has the potential to increase consumer costs by $46.6 billion, or $813 annually per account, in addition to the $1500 in duplicative fees for retirement savers that have already paid a fee on their commission-based accounts.”

In addition, AAF research revealed that “based on a minimum balance requirement of $30,000, the rule could force 28 million Americans out of managed retirement accounts completely. Even with a minimum account balance of $5,000, over 13 million would lose access to managed retirement accounts.”

FSR supports a “best interest” standard. However, FSR also believes the Securities and Exchange Commission (for securities) and state insurance authorities (for insurance products) should help lead efforts to develop and implement such a standard to ensure it is applicable to different types of investment accounts.