The American Council of Life Insurers (ACLI) continues to stand by their position that life insurers’ core activities do not pose any systemic risk.

A systematic risk is a system-wide financial crisis that is apparent when sharp decline in asset value and economic activity takes place. There is no great risk that life insurers’ core activities will prompt any major loss in economic value that is serious enough to have any major impact on the real economy.

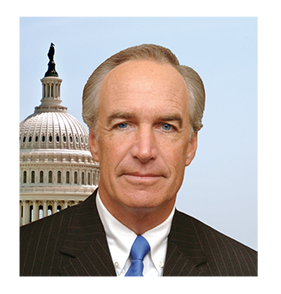

“These core activities involve providing consumers with financial protection and retirement security. Life insurers fulfill that mission on a daily basis, paying out $1.6 billion to customers and continue to advocate for a strong regulatory system that will help ensure they can effectively continue that mission,” said Dirk Kempthorne, ACLI President and CEO.

The ACLI President stressed the importance of state regulations imposed on life insurance companies.

Kempthorne said, “It also is important to keep in mind that life insurance companies are heavily regulated. State insurance departments have wide authority to oversee all aspects of the industry’s activities, including investments, market conduct and capitalization requirements. Nationwide standards for life insurers’ financial regulation are maintained via the states’ financial solvency accreditation program. Certain life insurance company activities are also regulated by the U.S. Securities and Exchange Commission and the U.S. Commodities Futures Trading Commission.”