U.S. Sens. Pat Toomey (R-PA) and Kyrsten Sinema (D-AZ) introduced a bill that would exempt small personal transactions that use virtual currencies for goods and services from taxation.

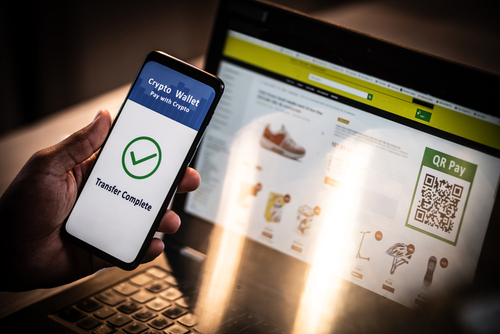

The Virtual Currency Tax Fairness Act seeks to simplify the use of digital assets for everyday purchases by creating an exemption for gains of less than $50 on personal transactions and for personal transactions under $50.

“While digital currencies have the potential to become an ordinary part of Americans’ everyday lives, our current tax code stands in the way,” Toomey said. “The Virtual Currency Tax Fairness Act will allow Americans to use cryptocurrencies more easily as an everyday method of payment by exempting from taxes small personal transactions like buying a cup of coffee.”

Currently, every time a digital asset is used, a taxable event occurs. So, if a person uses digital assets to purchase a cup of coffee, the individual would owe capital gains on the transaction if the digital asset appreciated in value—even if it appreciated by only a fraction of a penny.

“We’re protecting Arizonans from surprise taxes on everyday digital payments, so as use of digital currencies increases, Arizonans can keep more of their own money in their pockets and continue to thrive,” Sinema said.

Further, the bill includes an aggregation rule to treat all sales or exchanges that are part of the same transaction as one sale or exchange. This would prevent people from taking advantage of the exemption to evade taxes.

The bill has broad support across the cryptocurrency industry, as it drew praise from several organizations, including the Coin Center, the Blockchain Association, the Crypto Council for Innovation, and the Chamber of Digital Commerce.

“Cryptocurrency needs the same exemption for small, personal transactions that we have for foreign currency,” Jerry Brito, executive director of Coin Center, said. “This would foster use of crypto for retail payments, subscription services, and microtransactions. More importantly, it would foster the development of decentralized blockchain infrastructure generally because networks depend on small transaction fees that today saddle users with compliance friction that no doubt costs the economy more than the tax revenue that’s otherwise generated.”

A companion bill, sponsored by U.S. Reps. Suzan DelBene (D-WA) and David Schweikert (R-AZ), has already been introduced in the House.

“The use of virtual currencies for retail payments continues to increase in popularity, making it critical for Americans to understand their tax obligations,” Kristin Smith, executive director of the Blockchain Association, said. “By providing an exemption for small everyday purchases, the Virtual Currency Tax Fairness Act eases the burden for consumers and allows for greater use of virtual currencies for more people. We’re proud to support this bipartisan bill in the Senate.”